.jpg)

When the stock price breaches these price bands, trading in the stock is halted market-wide. All the details are in the NMS Plan to Address Extraordinary Market Volatility PDF. Following an IPO, the security will not begin trading on IEX until the price bands are received from the SIP.

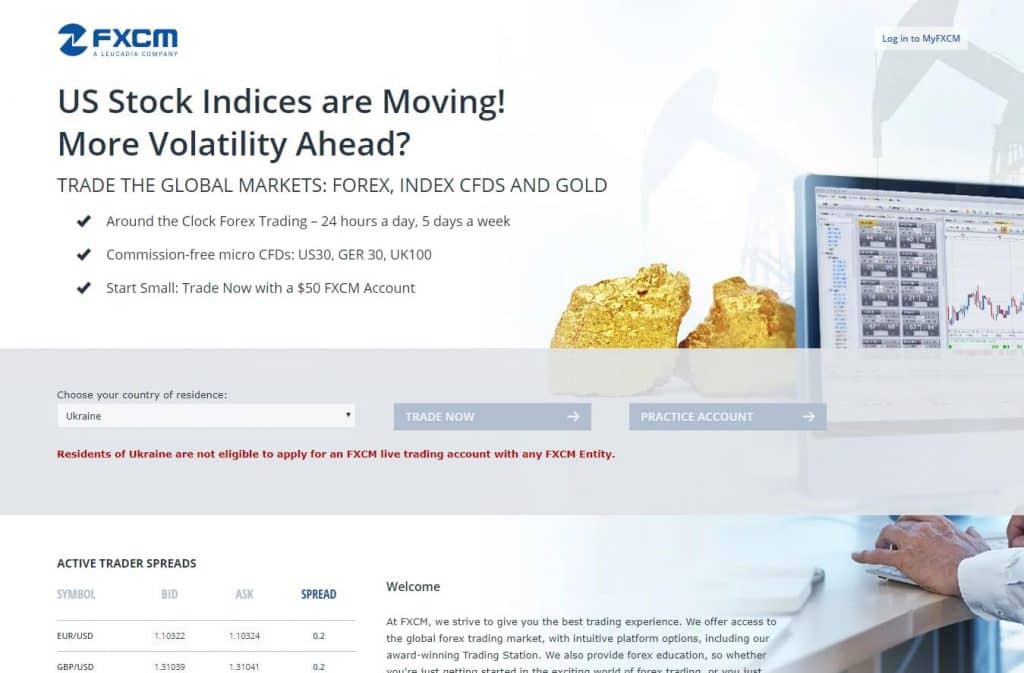

Stock trading halts are temporary suspensions in trading due to sudden and abrupt price movements up to a certain percentage range. In other words, when the price touches those percentage bands, a market halt is triggered. The percentage bands act as circuit breakers that svsfx forex broker review and comparison 2020 temporarily suspend trading in the stock. The price bands, consisting of a Lower and Upper Price Band for each NMS Stock, are calculated by the two SIPs – CTA and Nasdaq UTP. The SIPs calculate upper and lower price bands by applying a formula to a Reference Price, which is the arithmetic mean price of Eligible Reported Transactions over the prior five minute period. The first Reference Price of the day is either the primary market’s opening price or the primary market’s previous day’s closing price/last sale when opening on a quote.

Some Stocks Get Halted on ‘LULD Bands.’ What It Means

These important innovations aim to deliver tangible benefits to market participants, liquidity providers and global investors. To simplify, the “maximum” pause time is 10 minutes, but the primary listing exchange could choose to pause for longer than this. If the primary listing venue does not resume trading after 10 minutes, other trading venues are permitted to start trading in the stock. Note that there are exceptions which are all how to become a cloud engineer detailed in the NMS Plan to Address Extraordinary Market Volatility PDF. You cannot buy on limit up or limit down because trading in the security gets halted as the price reaches the limit bands.

- On May 31, 2012, the Securities and Exchange Commission (SEC) approved, on a pilot basis, a National Market System Plan, known as the Limit Up/Limit Down (“LULD”) Plan, to address extraordinary market volatility.

- Many exchanges across the world have set thresholds – or circuit breakers – for securities and market indices to keep volatility in the market at appropriate levels.

- For example, in the event that a disruption prevents Nasdaq from conducting a closing auction, pursuant to such rules, Nasdaq could designate NYSE Arca to perform that function, and vice versa.

- When the stock price breaches these price bands, trading in the stock is halted market-wide.

- When a Limit State occurs, the SIPs indicate the National Best Bid (Offer) as a Limit State Quotation.

- In April 2011, the Financial Industry Regulatory Authority and national securities exchanges proposed to establish “limit up – limit down” or LULD rules to control extreme market volatility in the U.S stock markets.

The New York Stock Exchange said Monday it was investigating a “technical issue regarding LULD Bands.” That’s a more complicated way of saying there’s too much volatility for some stocks to function. Please consult each Participant market’s trading rules to learn how its order types are treated under the Plan. Limit Order Price Checks reject limit orders that are priced too far away from the prevailing price of the security.

Limit Up-Limit Down

Please note that IEX will not discern between securities subject to the LULD Plan and those not subject to the LULD Plan at this time. Therefore securities not subject to the LULD Plan will remain halted on IEX for the remainder of the trading day if they were first halted and then unhalted during the Regular Market Session. I’ve seen stock volatility halts before, and I thought they were always 5 minutes long. The first GME volatility halt lasted 5 minutes, but the second volatility halt lasted 14 minutes. The protocols for handling a trading pause are established by the exchanges. Then on Feb 25, 2021, GME had 4 volatility halts in the morning, each of which lasted 5 minutes.

In April 2011, the Financial Industry Regulatory Authority and national securities exchanges proposed to establish “limit up – limit down” or LULD rules to control extreme market volatility in the U.S stock markets. When the National Best Bid (Offer) is below (above) the Lower (Upper) Price Band, the SIPs disseminate the National Best Bid (Offer) with an indicator identifying it as unexecutable. Trading immediately enters a Limit State if the National Best Offer (Bid) equals but does not cross the Lower (Upper) Price Band.

What is the SEC limit up – limit down rule?

Exchanges apply trading collars to a range of potential executions, including both auctions and market orders received during the continuous trading day. Market-wide circuit breakers may result in a temporary trading halt, or under extreme circumstances, close the markets before the normal close of the trading session. From global shocks like Coronavirus and oil price fluctuations, market participants must always be prepared for unanticipated volatility. There is a comprehensive range of actions, rules and market mechanisms that aim to prevent extreme price dislocations and temper extraordinary volatility.

.jpg)

Trading Basics

Every security has an upper and lower price band with the reference price as the mid-point. If an offer reaches the lower price band or a bid reaches the upper price band that stock will enter a limit state (a pause) for 15 seconds. Trading collars are parameters that prevent trades from executing outside of a designated price range.

- The price bands, consisting of a Lower and Upper Price Band for each NMS Stock, are calculated by the two SIPs – CTA and Nasdaq UTP.

- If the market does not exit a Limit State within 15 seconds, the Primary Listing Exchange declares a five-minute Trading Pause, which halts trading on all exchanges and off-exchange trading venues where that security is traded.

- The Closing Auction is the last event of the core trading day, and it’s important because it determines the Official Closing Price for each security.

- The New York Stock Exchange said Monday it was investigating a “technical issue regarding LULD Bands.” That’s a more complicated way of saying there’s too much volatility for some stocks to function.

- The first Reference Price of the day is either the primary market’s opening price or the primary market’s previous day’s closing price/last sale when opening on a quote.

- In other words, when the price touches those percentage bands, a market halt is triggered.

- New orders within the price guardrails can bring the stock out of the limit state.

Initial Public Offerings (“IPOs”)

If no eligible trades have occurred in the prior five minutes, the previous Reference Price remains in effect. The Reference Price is updated after 30 seconds only if a new Reference price would be least 1% away from the current Reference Price. Following a market disruption or trading halt on a primary listing market, all U.S listing exchanges have worked together to develop a contingency closing auction procedure to govern an alternate method of establishing an official closing price. For example, in the event that a disruption prevents Nasdaq from conducting a closing auction, pursuant to such rules, Nasdaq could designate NYSE Arca to perform that function, and vice versa. The most frequently-used percentage bands are 5%, 10%, 20%, and $ 0.15 or 75%, whichever is lesser.

During the Pre- and Post-Market Sessions, IEX will resume trading of a security immediately after receipt of either a unhalt message or trading has commenced on the primary listing exchange (without the need to wait for price bands). Limit down and limit up in the futures market Technical analysis in forex are price bands that restrict the prices of futures contracts from moving outside of them. Like stock markets, futures markets also impose these restrictions to keep extreme volatility in prices under check. A limit down restricts price from falling beyond a specific percentage that is determined using a reference price, usually an average of the previous few periods or the previous day’s closing price.

Stop Limit Orders – How to Execute and Why Traders Use Them

When a Limit State occurs, the SIPs indicate the National Best Bid (Offer) as a Limit State Quotation. Trading exits a Limit State if, within 15 seconds of entering the Limit State, all Limit State Quotations are executed or canceled in their entirety. If the market does not exit a Limit State within 15 seconds, the primary listing exchange declares a five-minute Trading Pause. If a security is in a Trading Pause during the last 10 minutes of regular trading hours, the primary listing exchange will not reopen trading and will attempt to execute a closing transaction using its established closing procedures.

.jpg)

.jpg)

.jpg)

.jpg)