Breeze is billed monthly and is based on an annual agreement. Breeze Premier is billed annually and based on an annual agreement. All contracts include the option to cancel at any time within the first 30 days. Cut down on data entry mistakes and increase transparency when your teams works from a single source of truth.

Yardi Breeze vs. Yardi Breeze Premier:

Day-to-day operations are intimately tied to asset value and investment performance. Our solutions help attract and retain occupants with advanced marketing and online services, for example. Electronic billing significantly cuts the cost of collecting and processing rents.

Refreshingly simpleproperty management software

It is a leading provider of comprehensive solutions that cater to a wide range of real estate management needs. Whether you’re a property manager, owner, or investor, you can enjoy the benefits of this software to manage your real estate business efficiently. Maintaining multiple systems can be expensive, time-consuming and error-prone — making it hard to access and analyze your data. We seamlessly integrate asset management, facility operations, forecasting, financials, construction and leasing in one system. The result is a simplified IT footprint and lower total cost of ownership. Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and associations.

Still deciding on which software is best for your property management portfolio?

- You also need to drive revenue, attract and retain tenants, and satisfy a range of stakeholders.

- Voyager is a comprehensive system for real estate operators with unique and dynamic requirements.

- Managers can be up and running on Yardi Breeze in minutes with its streamlined set-up and on-boarding tasks.

- It helps landlords, investors, leasing agents, maintenance technicians and other real estate professionals track and execute projects and data more efficiently.

- Its user-friendly interface, unique tools, and various services have made the software quite popular.

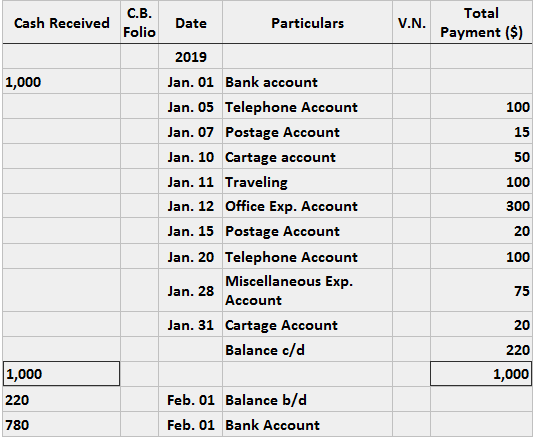

- Accurate and timely accounting and bookkeeping to maximize ROI and spur growth.

Regular feature updates will occur automatically, ensuring you always have the latest software available. You may choose to utilize optional add-ons that carry a per-transaction cost, like resident screening. understanding s corporations Yardi has emerged as one of the best platforms for managing your real estate portfolio. Its user-friendly interface, unique tools, and various services have made the software quite popular.

For more information on how our resident services bundle can help your multifamily organization, get in touch with a Yardi representative. We will work with you to customize a solution stack that fits your unique business. We also offer customizable solutions like mobile apps and websites for your properties.

Click the link sent by the company in the email and follow the instructions to create a new password. Make sure it meets any specified security requirements https://www.quick-bookkeeping.net/asset-turnover-ratio-formula-real-word-examples/ (e.g., length, complexity). Even if you’re cautious, there are many circumstances in which you can face issues with logging in to Yardi.

Choosing the right property management software to organize, optimize and grow your business is a big decision, but it shouldn’t be overwhelming. Use the property management software checklist to help you make the right decision when reviewing the solutions available to you from any real estate technology provider. As Yardi has several platforms, they are tailored to cater to different segments of the property management industry. One is Yardi Breeze, ideal for small to mid-sized property management companies looking for an easy-to-use, cloud-based solution.

Managers can be up and running on Yardi Breeze in minutes with its streamlined set-up and on-boarding tasks. And, its built-in live chat support feature allows users to get answers to questions quickly from dedicated Yardi Breeze support experts. It is very user-friendly, and the ability to live chat with the support staff is fantastic.

Our real estate management software includes integrated solutions for accounting, marketing and lease execution, market intelligence, energy management, end-to-end procurement, business intelligence and much more. Breeze Premier is property management software built on the same refreshingly simple platform as Breeze. But it adds functionality for businesses with more advanced or unique needs such as custom reporting, invoice processing, job cost tracking and investment management. Most of these features apply universally across all property types, while some are specific to certain property types.

As you’ve seen Yardi login is not as difficult as you might have thought. It’s just you need to verify which application you want to log in to and some key things to remember. Moreover, you can always come back to this document whenever you feel stuck. We’re sure, this document has valuable information that you are looking for. In addition, you can also contact our Yardi experts if you want to scale up your property management business.

Are you getting started with this tool to level up your real estate game? Well, it’s a great idea, however, learn the basics of Yardi login first to maximize its potential. This blog will help you understand the steps for successfully logging into the software.

Make solid data-backed decisions, reduce costs and achieve consistent growth. Accurate and timely accounting and bookkeeping to maximize ROI and spur https://www.accountingcoaching.online/ growth. The IT department configures 2FA settings in the Yardi admin panel, specifying which 2FA methods are allowed and setting up user enrollment.

Save time and money with association management software that makes work a breeze. Yardi Breeze’s intuitive design and modern, user-friendly interface make it easy to complete tasks from anywhere. Be confident that your numbers will always add up with our industry standard built in payables, receivables and general ledger functions. Contact one tech support team for all your needs, simplifying the process and finding the right answers faster. Follow us on our social media channels for all the latest industry updates and information. Unless your company established a login portal on your company website, you won’t be able to log in to your account from search engines like Google or Bing.

That’s why, we present the following tips to solve problems that you may encounter during the process. Yardi Breeze has a simple, affordable pricing model with monthly fees starting at $1 per unit. Live chat with our support team to find the right answers faster. Yardi Breeze Premier is intuitive and easy to use.We love the built-in accounting. Deliver customized financials and offer property performance comparisons within an owner’s portfolio.

.jpg)

.jpg)

.jpg)