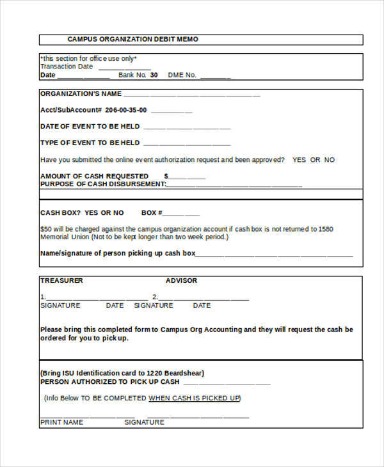

If you have pending transfers, you won’t be able to deactivate your account until Square sends these funds to your linked bank account. Once you’re in the dashboard, head over to the account settings section. new coins coming to coinbase 2021 This is where you’ll see a list of your bank accounts linked to your Square account. This might be labeled as your transactional bank account.

You can create numerous Square accounts using the same mobile number and bank account if you have different enterprises or need individual separate accounts. Similar to how you might manage various bank accounts, you may manage multiple Square accounts. But to prevent transactions from one account from being mixed up with another, you must have to maintain them separately. Keeping your Square transactions in check can be a real headache.

- This might be labeled as your transactional bank account.

- But if you have a Square debit card and you don’t use it anymore, so to prevent paying unnecessary charges, you should temporarily block your Square card.

- Click on your current bank account and start the deactivation process.

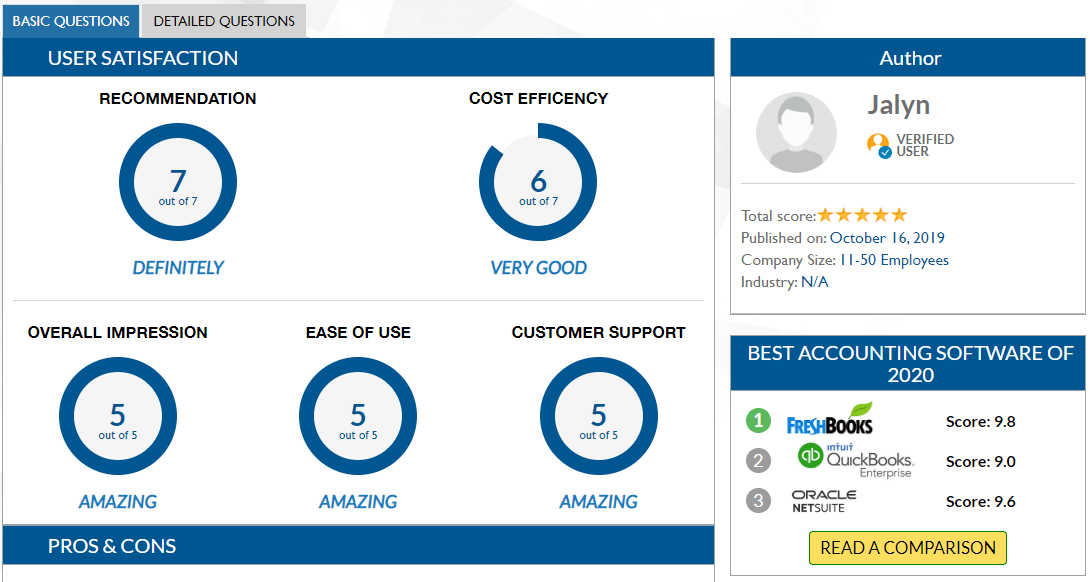

- Refer to our Advertising Disclosure to learn more about how we earn compensation from affiliate partnerships and how we maintain our independent editorial integrity.

- The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

With mixed-up dates, amounts, and the constant chance of losing track, it’s enough to drive anyone crazy. This accounting automation app integrates with over 30 payment channels, including Square, and syncs them with accounting software like QuickBooks, Xero and Sage Intacct. Square will need to verify it, so you’ll have to enter your new bank account information, including the account number and routing number. As you continue managing your payment options, it’s essential to consider whether the Square Terminal or Square Reader suits your business best. There is o direct how to day trade cryptocurrency way to delete an email account from Square.

How to Change Default PDF Viewer on Android

Depending on how you’ve configured your account, provide the necessary password and/or verification code to move on. Once you’ve tied up all your account’s loose ends, you’ll be ready to deactivate your Square account. Join the thousands of people like you already growing their businesses and knowledge with our team of experts. We deliver timely updates, interesting insights, and exclusive promos to your inbox. A CSV file will download to your computer, which you can open using Microsoft Excel, Google Sheets, or another common spreadsheet software.

Also, all of your transaction money is transferred to your bank account the next day it happens. A .CSV file will download to your computer, which you can open using Microsoft Excel or another common spreadsheet software. A CSV file will download to your computer, which you can open using Microsoft Excel, Google Sheets or other common spreadsheet software. If you’re just needing a different payment processor, you can try something like Helcim, or you can check out a thorough breakdown of the differences between Stripe VS Square. Next, you’ll need to enter your security information to confirm that you have the authority to shut down your account.

This will ensure you do not continue getting charged for Square Online services you are no longer using. Let’s take a look at how the Square QuickBooks Online integration via Synder works. Synder grabs not only real-time but also historical data from your Square account and zips it straight into QuickBooks Online. This way, your financial records are always up-to-date and ready for smooth reconciliation with your bank statements. In this step-by-step guide, we’ll walk you through how to remove a bank account from Square and update bank account information. If you’re a business owner, chances are that you use many tools and apps.

Step 3. Remove your current bank account

If you’re using a new payment processor, you’ll need to familiarize yourself with its policies to see if you’re able to use its infrastructure to handle legacy transactions. Failing that, you may have to get creative, either offering refunds through more direct means, store credit, or gift cards through your new provider. Click on your current bank account and start the deactivation process. Square might ask you to how to code a website using html and css confirm your choice, so be ready to click a few confirmation buttons. Square hardware is not linked to any specific account holder or bank account, nor do they need to be activated. Your personal information will not be compromised if you sell, recycle, or share your hardware between Square accounts.

A Visual Guide To Credit Card Processing Fees & Rates

To enable businesses to accept several payment forms, Square Payments is an online system that connects and processes payments using Square hardware and POS software. If you are a business owner and a Square user who wants to automate payment and wondered what happens when you deactivate your Square account? We are bringing you a helpful guide that will resolve all your doubts, like how to delete Square account and learn if can Square legally hold your money.

Now, select your email address or phone number to receive a verification code. There are a few things we recommend doing before you deactivate your Square account. The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. Help us to improve by providing some feedback on your experience today. Refer to our Advertising Disclosure to learn more about how we earn compensation from affiliate partnerships and how we maintain our independent editorial integrity.

Finally, click on Confirm to delete your Square Online account. Get into your Square account on your browser and click on your business name from the top right corner. Click on Change next to the current email address, as shown below. Click on Sign In from the top right corner of the screen and sign into the present owner’s Square account.