It’s like having a front-row seat to a comedy show, where every punchline is a successful transaction. With Accenture’s transformative solutions, companies can say goodbye to manual data entry and tedious paperwork. Instead, they can embrace https://www.quick-bookkeeping.net/ a future where intelligent automation takes care of the mundane tasks, allowing employees to focus on more strategic and value-added activities. It’s all done with a touch of humor to keep things light-hearted and entertaining.

Q. What services does an accounting firm in Singapore offer?

Outsourcing your accounts payable function resolves these challenges and more, with Deloitte reporting that 65% of successful organizations include outsourcers in their delivery model. Companies offering accounts payable services focus only on your AP processes; completing the work faster and more accurately. Also, with AP processes being taken care of, your employees can focus on higher value tasks with increased efficiency leading to better productivity overall.

The Pros of Outsourcing Accounts Payable Processes

Any company dealing with accounts payable best practices in-house is bound to have greater control over its processes. Emergencies can be prioritized and handled straight away with direct approvals. With a third-party provider, you will have to play by their terms and timings. They might be located far away and the lack of transparency in processes can become a serious issue. Outsourcing companies may not always be transparent in how they deal with your AP processes.

How to start a virtual assistant business

- As the business world becomes more competitive, companies continually look for ways to improve services and increase cash flow.

- We are extremely pleased with the exceptional hospital billing services provided by Invensis.

- Data security and compliance should be top priorities when outsourcing accounts payable functions.

Accountants, like other professionals, come with varying degree of expertise. Those employed by the accounting services have the industry-wide knowledge can easily simplify your compliance. With their meticulous attention to detail and knowledge of industry regulations, they ensure that every payment is accurate and compliant. So, not only do you save money, but you also avoid the comedic disaster of financial mishaps.

The landscape of finance and accounting outsourcing is rich and varied, offering a plethora of choices for businesses seeking to enhance their financial operations. This section delves into the top providers, each distinguished by their exemplary services, technological prowess, and unwavering commitment to client success. These providers have been meticulously selected based on their comprehensive range of services, global reach, innovative solutions, and proven track record in delivering exceptional financial expertise. Accounts payable outsourcing is a business strategy in which a company delegates the management and processing of its accounts payable (AP) functions to an external service provider. Accounts payable refers to the money a company owes to its suppliers or vendors for goods and services received but not yet paid for.

Tips For Choosing the Right Accounts Payable Outsourcing Partner

If your current accounts payable process has considerable cash leaks or issues, moving to outsourced AP may improve budget optimization even after the cost of service fees. The average cost to process an invoice is as high as $15, and outsourcing or automation may offer up to a sixfold reduction in processing costs. Switching to another outsourced accounting services provider may be time-consuming and costly. Or, you can choose to install intelligent AP automation software that poses little risk to your security. This includes not only processing invoices but also managing payments, ensuring compliance, and handling vendor queries.

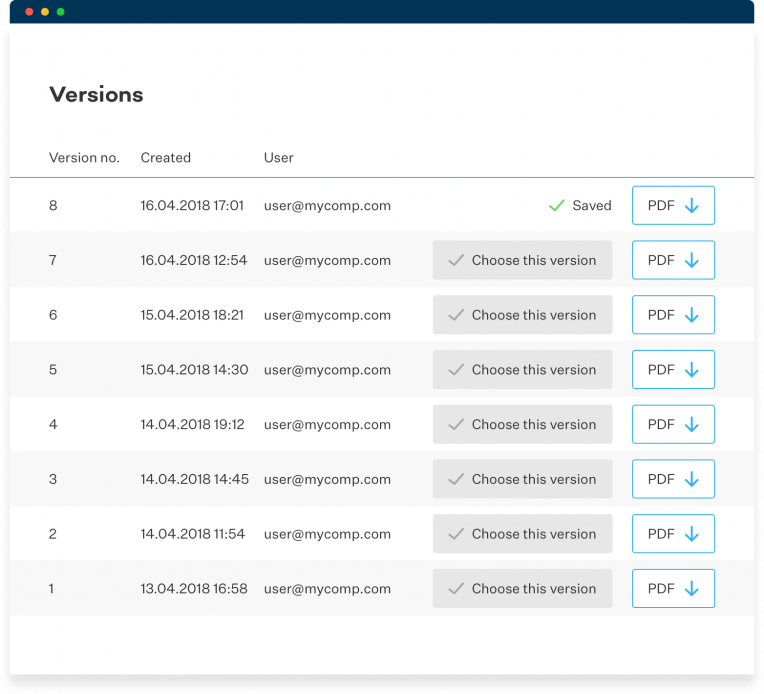

Finally, continuous improvement strategies should be implemented to leverage the insights gained from outsourcing and adapt to changing business needs and market conditions. This may involve refining processes, implementing new technologies, or adjusting the scope of outsourced services to align with evolving requirements. Additionally, it’s essential to regularly review and adjust the scope of outsourced services to align with changing business requirements. As an organization grows or shifts its strategic focus, the outsourcing engagement may need to be modified to accommodate new needs or priorities.

For many firms, the AP personnel tasks are not always as integrated into the business as another function such as operations, so it can be an attractive offering to outsource some of the paperwork. Of course, there are some downsides to using third-party accounts payable outsourcing services. Outsourced accrued revenue affecting net income accounts payable providers have all the resources they need to optimize your process, including automation and reporting tools. Instead of going through the process of acquiring these tools themselves, many companies choose to outsource to get access to their benefits at a fraction of the cost.

The Pineapple Corporation is a US-based business process outsourcing company that offers automation for all business interactions and other manual work. For this, the company offers an AI digital platform to manage communications with organizations, stakeholders, and customers. As with any organizational change, teething issues may arise when a company decides to outsource its AP process. Transitioning from an in-house AP department to an external provider can potentially lead to duplicated entries and other early challenges. To preempt these issues, it is advisable to conduct an internal meeting with staff before implementing any changes. This meeting should focus on discussing the chosen outsourcing partner, its impact on workflow, and proactive measures that employees can take to ensure a smooth and seamless transition.

Evaluate the provider’s technological infrastructure, including their software solutions, automation tools, data management systems, and integrations with other platforms you may be using. Ensure their technology aligns with your organization’s needs and can seamlessly integrate with your existing systems. However, businesses that want to improve their service levels, while cutting down on hiring costs, may benefit from partnering with AP https://www.personal-accounting.org/what-is-an-angel-investor-definition-profile/ outsourcing providers. The pricing could be more cost-efficient and profitable than the overhead expenses necessary to hire and train new personnel when your business relies on manual processes. Accounts payable outsourcing is the process of hiring and using an outside vendor to manage and execute certain AP tasks, such as processing and paying invoices. Accounts payable outsourcing is a subset of business process outsourcing (BPO).

Automation offers all these outcomes without sacrificing the security or visibility of your AP process. Moreover, invoice processing speed is limited by your staff’s abilities and work hours. Third-party accounts management companies have modern facilities and software to efficiently and accurately accomplish tasks. This comprehensive guide has provided a detailed overview of accounts payable outsourcing, covering its benefits, processes, best practices, and considerations for choosing the right partner. Accounts payable outsourcing relies heavily on technology to streamline processes, ensure accuracy, and enhance visibility.

They offer high quality BPO service processes and IT outsourcing across several industries. Shockwave Media is a cutting-edge outsourcing partner with headquarters in Australia that helps any small business scale online. They offer a complete digital transformation service like corporate marketing strategy, human resource management, and lead generation with an easy onboarding process. When you outsource, you can bypass a lot of these additional costs for the time being, as most outsourcing companies handle all of this themselves. Outsourcing has gained tremendous popularity because delegating business processes to the right companies can improve organizational efficiency greatly.

However, managing accounts payable can be a time-consuming and complex task, which is why many companies turn to outsourcing as a solution. Since 2000, Invensis has been catering to the diverse outsourcing needs of clients for multiple industries and constantly striving to add value to clients’ businesses. When choosing an accounts payable outsourcing company, it’s important to consider factors such as the provider’s reputation, track record, and the types of services they offer. You should also consider the provider’s fees and pricing model, as well as any additional costs or charges that may apply.

Accounts payable (AP) outsourcing is entrusting your organization’s accounts payable processes to a third-party company specializing in managing accounts payable. This can range from invoice receipt and processing to vendor management and payment processing. Imagine a world where invoices are processed and payments are made in the blink of an eye.

We have assisted many organizations across the globe to simplify their accounts payable workflow, limit access and establish superior control, and prioritize invoicing processes. These have honed our skills to a level where we can meet your needs with full competency. Data security and compliance should be top priorities when outsourcing accounts payable functions. Assess the provider’s security measures, including data encryption, access controls, and disaster recovery protocols, to ensure the safety and integrity of your financial information. Additionally, verify their compliance with relevant regulations, such as the Sarbanes-Oxley Act (SOX), the General Data Protection Regulation (GDPR), and industry-specific standards.