Do the idea of located in the country otherwise suburbs interest to you? Think about to order a home without money off? Which have a good USDA Rural Innovation financing, can help you both!

USDA (RD) mortgages is actually regulators recognized fund. The mortgage are funded otherwise got its start from the a loan provider (like MiMutual Mortgage) however, keeps a promise from the You Department of Farming Rural Development (USDA RD). Therefore be sure, there was faster exposure on the financial, ergo enabling much more good mortgage terminology toward borrower.

Zero Advance payment:

Probably the better advantageous asset of a USDA RD loan ‘s the down-payment requirement. Today, many people find it hard to store a significant out of discounts. Most of the time, saving right up getting a deposit was cited among the most significant barriers to help you homeownership.

Flexible Borrowing Conditions:

USDA RD finance have more easy borrowing criteria and bankruptcy proceeding assistance when comparing to old-fashioned fund. Just like the USDA itself will not lay at least credit score, lenders set her minimums. Of several loan providers wanted a rating of at least 640. MiMutual Home loan, not, allows fico scores only 580, making it loans Silverhill AL mortgage program a good option for individuals having faster-than-best borrowing histories. Which independency opens potential for individuals who possess encountered economic challenges in past times.

Keep costs down

USDA RD money give you the cheapest home loan insurance premiums when versus other loan applications. Both upfront home loan advanced (MIP) as well as the yearly home loan insurance is cheaper than what are necessary for FHA financing. The RD MIP together with always cost not so much than just traditional Personal Mortgage Insurance rates (PMI).

Concurrently, not all of their settlement costs need leave pouch. The closing costs will likely be secure courtesy seller concessions (up to 6% of purchase price) or as a consequence of has, provide financing, otherwise county Deposit Advice (DPA) software.

Not only for sale:

MiMutual Home loan has the benefit of USDA RD loans for to get otherwise refinancing a house. If or not you purchase or refi, licensed consumers qualify for 100% money. The latest RD Improve program enables you to refinance your current RD financing effortlessly! As identity means, the procedure is a quicker, sleek procedure that waives the newest pest, better, and you can septic inspections. And no the newest assessment will become necessary!

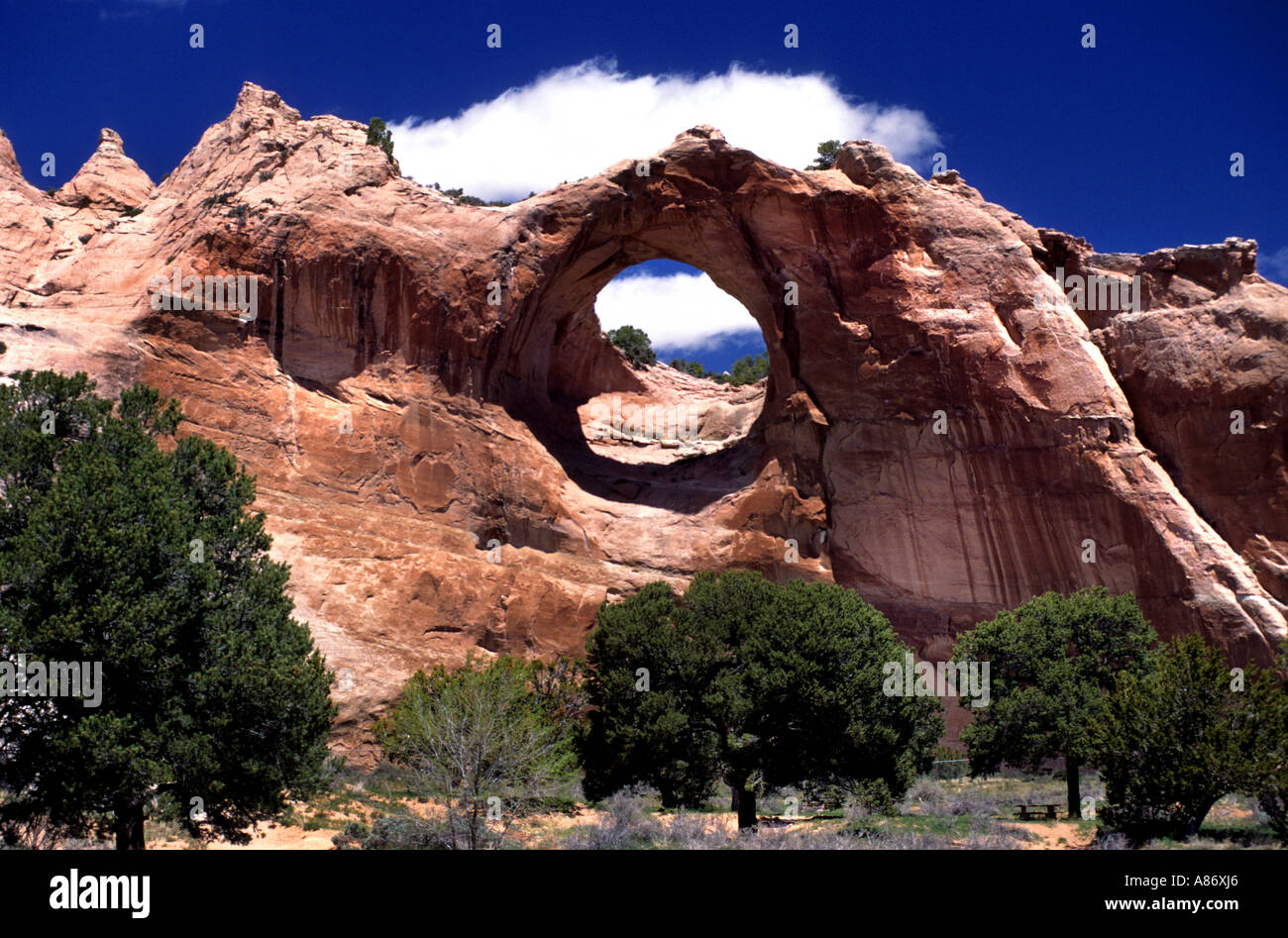

Support having Rural and Suburban Elements:

USDA RD funds are specifically designed to support rural and you may suburban teams. That it implies that individuals surviving in these components get access to reasonable financial support choice while promoting monetary innovation and you will balances.

So, now that there is talked about the benefits of the fresh RD financing, lets take a closer look on a few of the qualification standards:

You will find earnings guidance

You don’t have to become an initial-go out house buyer, you need to satisfy specific money assistance. RD financing indicate that a debtor do not surpass 115% of the regional average family earnings. Observe the present day earnings eligibility limitations, look at the USDA RD webpages during the:

The house need to be located in an outlying town

You happen to be curious, what’s thought rural? There are a variety from definitions with what comprises an effective outlying city compared to an urban or area area and this normally result in frustration throughout the a great property’s program qualification. While most anybody think of secluded, dusty state courses once they think rural, you’re astonished at how many attributes are in an excellent USDA outlined rural’ city. Society, geographic isolation, as well as the regional labor business are typical activities believed.

How to determine if your home is when you look at the a beneficial USDA designated outlying area is always to browse the program’s eligibility chart on: Click on this link!

Loan words, limits, and qualified possessions sizes

In place of a normal otherwise FHA mortgage, USDA does not lay a maximum mortgage count to have RD funds. And no limitation transformation rates, this may opened your options. However, RD funds are just readily available as a 30-year repaired financial, and again, have to be located in a place identified as outlying.

Qualified possessions products is unmarried household members land, PUDs, the fresh new construction (identified as less than one year old that have Certification of Occupancy),brief conversion and you can foreclosed property, site apartments and you can established are designed residential property eligible for the brand new Are made Home Airplane pilot System (certain condition qualifications constraints use).

Qualities not qualified to receive RD financial support are individuals who is actually income-producing, not as much as design, based in an urban area and you can/or not deemed as the very good, as well as hygienic (DSS) by USDA requirements. DSS standards simply speaking, guarantee the house is structurally secure, and you may everything in an effective doing work acquisition. In the event the a home is not meeting DSS requirements, it should be listed in a good resolve just before financial support or with the loan financing.

As you can tell, USDA RD financing are a great solution if you’re looking to live on off of the outdone street and need 100% investment that have Zero down. Very, whenever you are Installed and operating Rural, we’re prepared to assist allow you to get there!